Tired of paying sky-high premiums? Auto insurance doesn’t have to break the bank. You might be missing out on easy savings! Use these seven tried-and-true tips to trim your insurance costs without sacrificing coverage.

Ask for Discounts: Bundle, Low Mileage, and Good Driver Discounts You Probably Didn’t know About

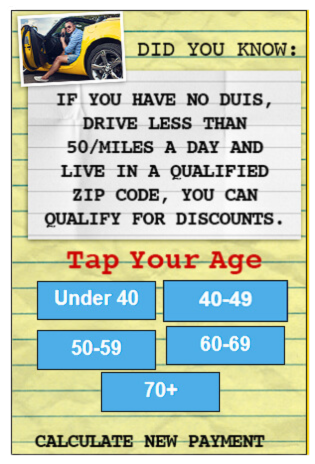

The first step to saving on auto insurance is to ask for discounts. Many insurance companies offer a variety of discounts that can significantly reduce your premiums. Here are some common discounts you might not be aware of:

Bundle Discounts – If you have multiple insurance policies (such as home and auto) with the same provider, you may qualify for a bundling discount. This can save you a substantial amount on your overall insurance costs.

Low Mileage Discounts – If you drive fewer miles than the average driver, you may qualify for a low mileage discount. This is because less time on the road reduces the risk of accidents, making you a lower-risk driver in the eyes of insurers.

Good Driver Discounts – Maintaining a clean driving record can earn you a good driver discount. Avoiding accidents and traffic violations shows that you are a responsible driver, which insurers reward with lower premiums.

Always ask your insurance provider about available discounts and ensure you’re taking advantage of all the ones you qualify for.

Time to Switch Providers?: How Shopping Around Every 6 Months Could Save You Hundreds

Loyalty to one insurance provider can sometimes cost you more in the long run. Shopping around and comparing rates from different insurers every six months can reveal significant savings. Insurance companies frequently adjust their rates and may offer better deals to attract new customers.

When comparing rates, make sure to:

- Get Multiple Quotes – Don’t settle for the first quote you receive. Compare rates from at least three different insurers to find the best deal.

- Compare Coverage Levels – Ensure you’re comparing apples to apples by looking at the same coverage levels and deductibles across different policies.

- Check for New Discounts – Different insurers offer different discounts. When shopping around, see if new providers offer discounts that your current one doesn’t.

By regularly shopping around, you can ensure you’re getting the best rate available and potentially save hundreds of dollars a year.

Raise Your Deductible—Smartly: How to Find the Right Balance Between Savings and Risk

Raising your deductible is another effective way to lower your auto insurance premiums. The deductible is the amount you pay out of pocket before your insurance kicks in. By increasing your deductible, you take on more risk, but your monthly premiums decrease.

To find the right balance between savings and risk, consider:

- Your Financial Situation – Ensure you can afford to pay the higher deductible in case of an accident. If an unexpected expense would strain your finances, a lower deductible might be a safer choice.

- Driving Habits – If you’re a cautious driver with a low risk of accidents, raising your deductible could be a smart move. However, if you frequently drive in high-risk areas or have a history of accidents, a lower deductible might be better.

- Insurance Savings – Calculate the premium savings from raising your deductible and compare it to the increased out-of-pocket cost. Make sure the savings are worth the additional risk.

A higher deductible can lead to significant savings, but it’s essential to choose a deductible you’re comfortable with financially.

Telematics Programs: Get Paid to Drive Safely with These Usage-Based Plans

Telematics programs, also known as usage-based insurance, use technology to track your driving habits and reward safe behavior with lower premiums. These programs typically involve installing a device in your car or using a mobile app to monitor your driving.

Telematics programs can offer benefits such as:

- Lower Premiums for Safe Drivers – If you have good driving habits (e.g., obeying speed limits, avoiding hard braking), telematics programs can lead to substantial premium discounts.

- Personalized Rates – Your insurance rate is based on how you drive, rather than demographic factors like age or location. This can result in fairer pricing.

- Feedback on Driving Habits – Many telematics programs provide feedback on your driving, helping you become a safer driver and potentially save more.

Check with your insurer to see if they offer telematics programs and consider enrolling to take advantage of personalized rates and potential savings.

Compare Online Tools: Why Comparison Shopping is the Key to Unlocking Better Rates

Online comparison tools make it easy to shop around for auto insurance and find the best rates. These tools allow you to input your information once and receive quotes from multiple insurers, saving you time and effort.

Here’s why you should use online comparison tools:

- Convenience – Get multiple quotes in minutes without having to contact each insurer individually.

- Comprehensive Comparison – See a side-by-side comparison of different policies, coverage levels, and premiums.

- Identify Discounts – Comparison tools often highlight available discounts, helping you find additional savings.

- Stay Informed – Keep up with changing rates and new offers from insurers.

Using online comparison tools can help you stay informed and ensure you’re always getting the best rate possible.

By following these seven simple tricks, you can drive smarter and cut your auto insurance bill today. Ask for discounts, shop around regularly, raise your deductible smartly, enroll in telematics programs, and use online comparison tools to find the best rates. With these tips, you can reduce your premiums without sacrificing coverage and enjoy peace of mind on the road.